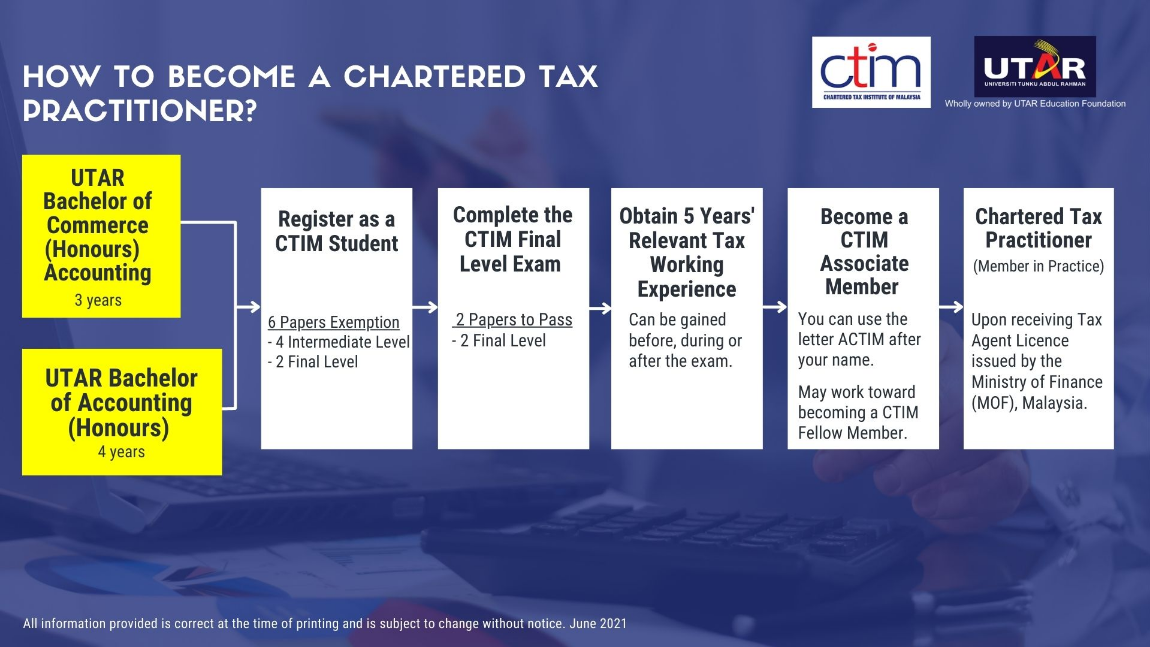

How to Become a Chartered Tax Practitioner?

UTAR collaborates with the Chartered Tax Institute of Malaysia (CTIM) to provide tax practitioner education to UTAR graduates of Bachelor of Commerce (Honours) Accounting and Bachelor of Accounting (Honours) programmes. After graduation, UTAR students will be exempted from 6 CTIM examination papers and will be needed to sit for the remaining 2 papers at the final level examination.

NOTE: Please keep in mind that this is merely a suggested path for your reference. The professional organisation may, at any time, amend the examination and membership requirements as judged necessary. As a result, it's necessary to double-check the present path with UTAR officials or the professional body before enrolling.