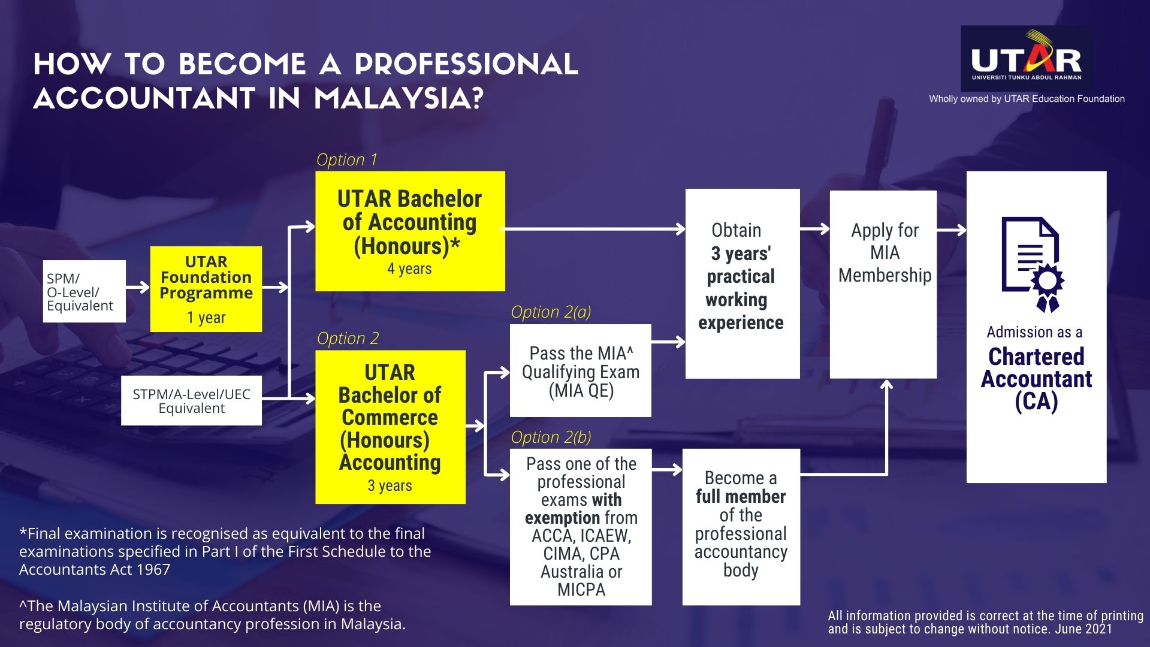

How to Become a Professional Accountant in Malaysia?

The term 'Accountant' is protected in Malaysia under the Accountants Act 1967 which indicates that no one can offer oneself out or practise as an accountant unless he is a member of the Malaysian Institute of Accountant (MIA). Therefore, a recognised degree as well as 3 years' practical working experience approved by MIA OR a full member of a professional accountancy body is required to become a qualified Accountant.

For students interested in becoming accountants, UTAR offers the following options:

(1) The 4-year Bachelor of Accounting (Honours) - The final examination of this degree is recognised as equivalent to the final examinations specified in Part I of the First Schedule to the Accountants Act 1967. To put it another way, graduates of this programme who have completed the work requirements can apply for MIA membership without becoming full members of the professional accountancy bodies.

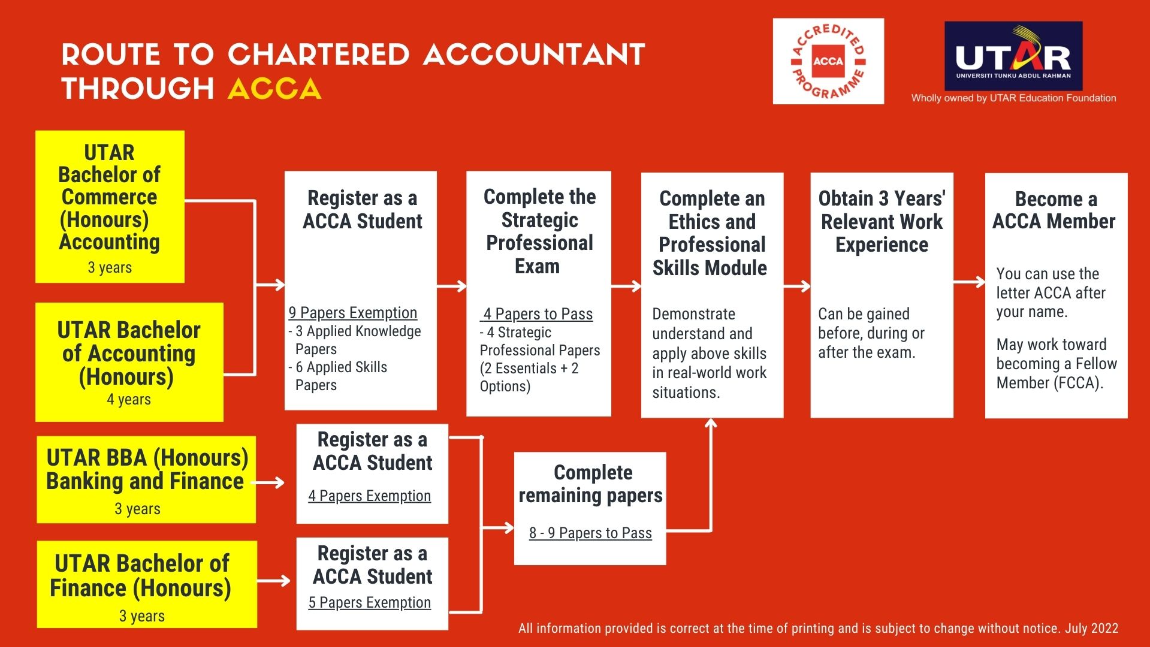

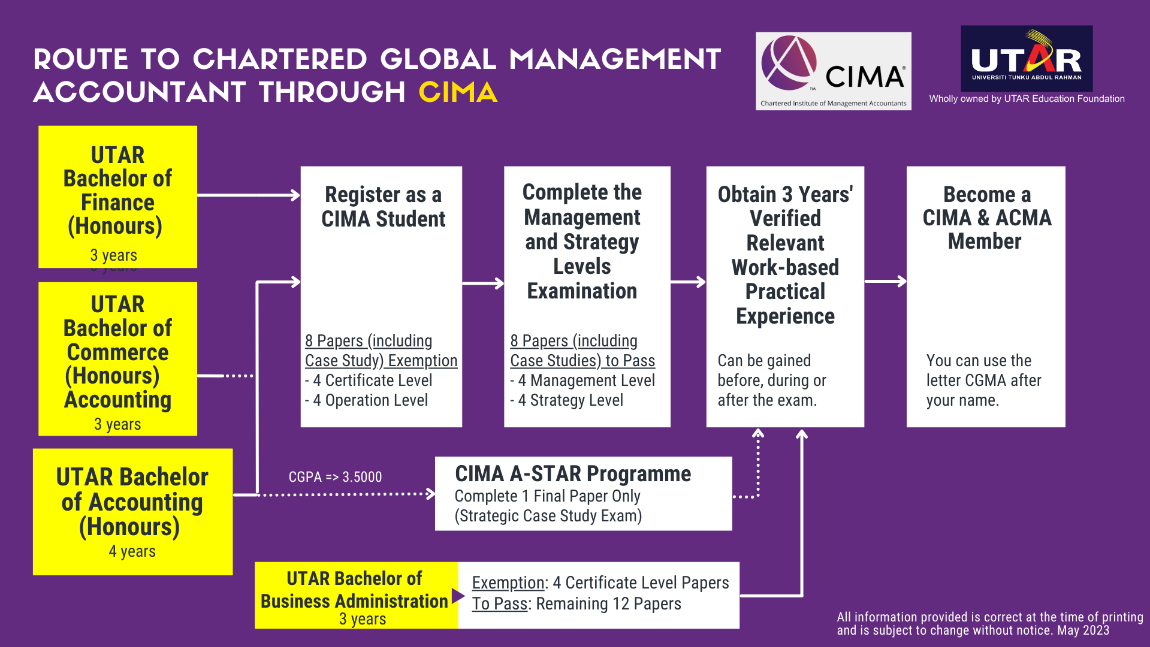

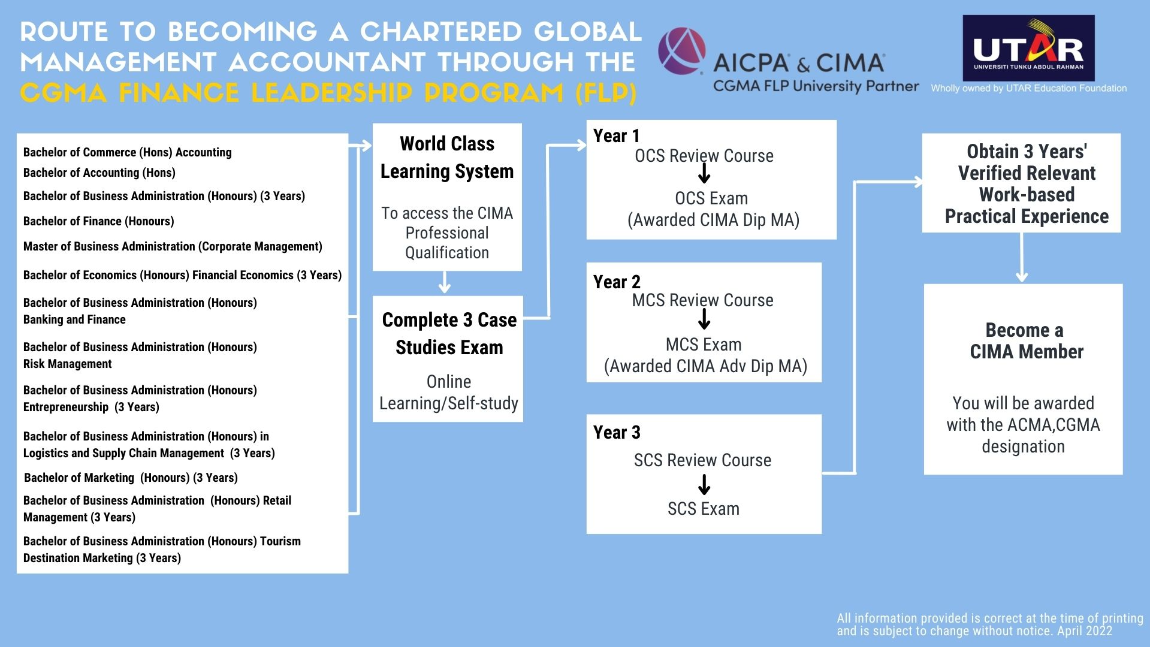

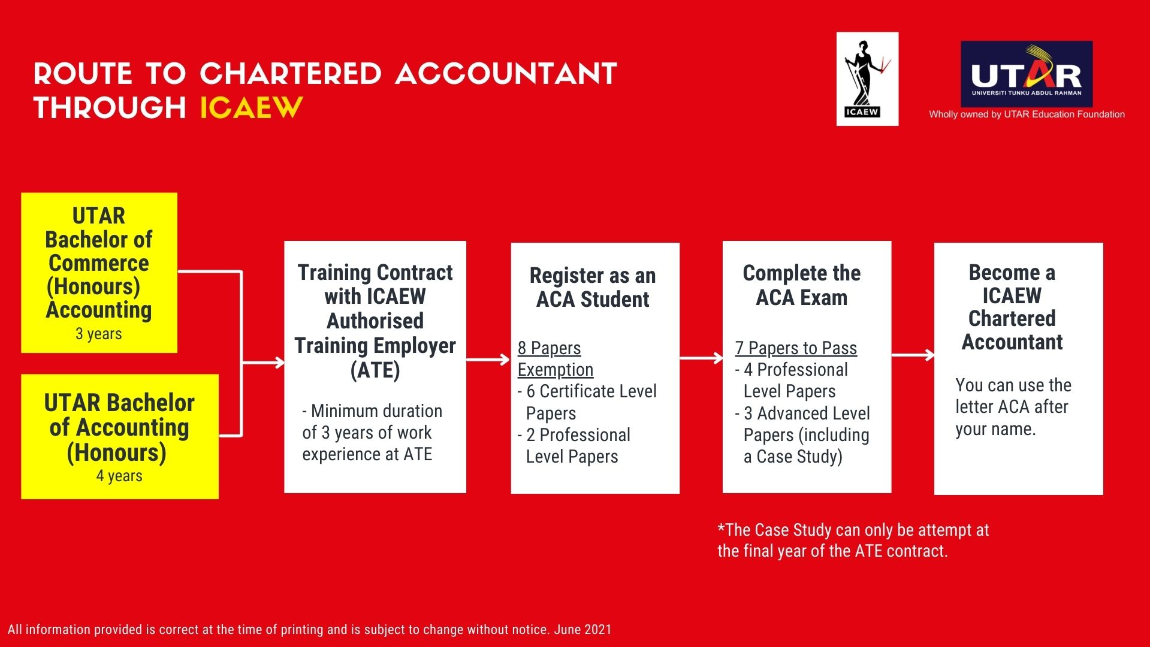

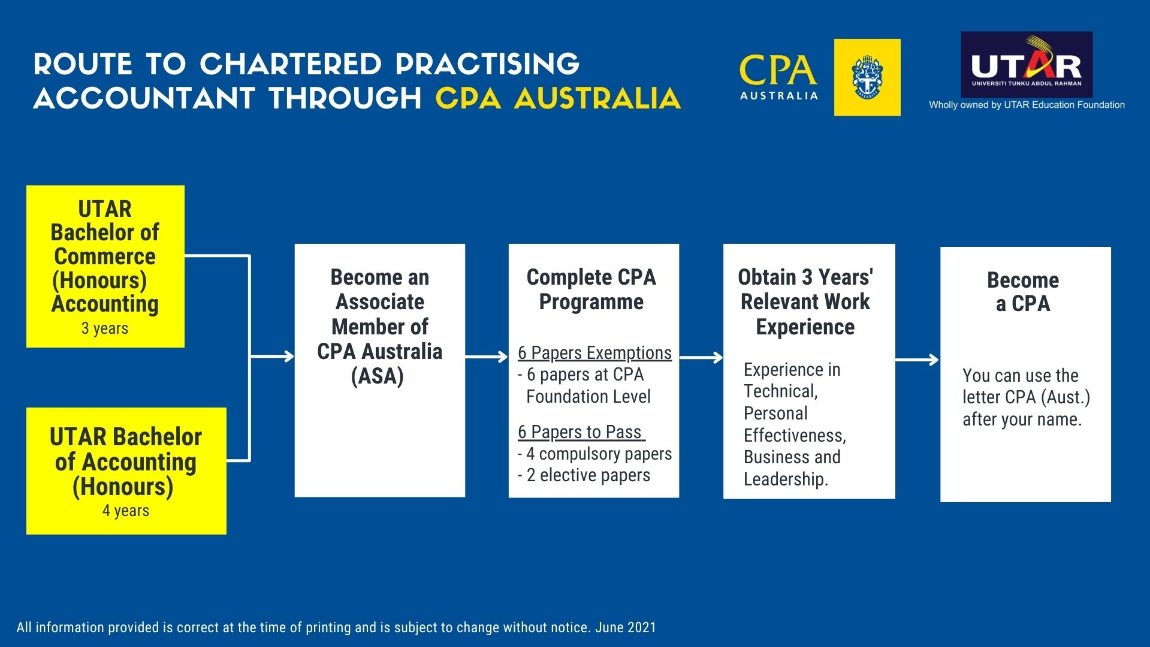

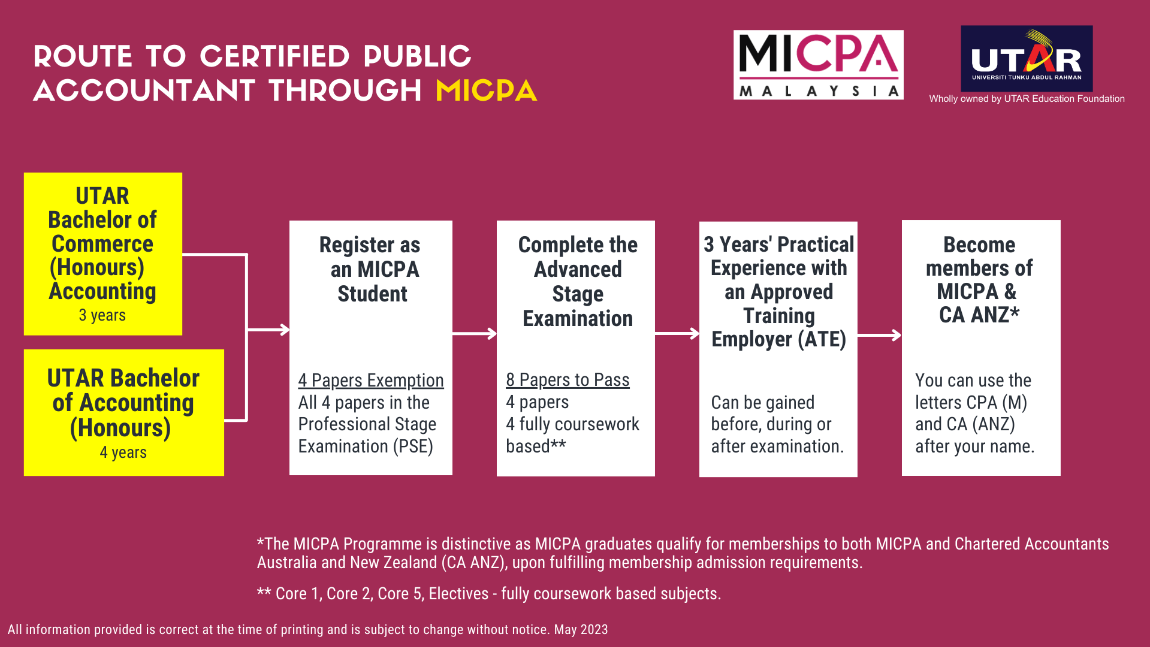

(2) The 3-year Bachelor of Commerce (Honours) Accounting - UTAR has partnered with numerous prominent professional accountancy bodies to allow its degree graduates to earn exemptions from the professional examinations, and become full members, of the professional accountancy bodies. These professional bodies are:

- The Association of Chartered Certified Accountants (ACCA), UK

- The Chartered Institute of Management Accountants (CIMA), UK

- Institute of Chartered Accountants in England and Wales (ICAEW), UK

- CPA, Australia

- The Malaysian Institute of Certified Public Accountants (MICPA), Malaysia

(3) Other similar programmes, such as Bachelor of Finance (Honours) and Bachelor of Business Administration (Honours), will be granted some exemptions from the professional accountancy bodies.

NOTE: Please keep in mind that this is merely a suggested path for your reference. Some professional bodies provide more than one means to meet a specific criteria, and these options are subject to change without notice. It is therefore critical to confirm the current pathway with UTAR officials or appropriate professional organisations at the time of enrolment.